With the potential of more job action from the Canadian Union of Postal Workers, the Province is reminding people they can continue to access provincial tax services during the ongoing labour dispute.

People are encouraged to use non-mail payment and application options to avoid late fees and penalties. During a disruption to postal services, people are still responsible for filing tax returns, claiming grants, applying for programs or refunds, and making payments and remittances on time.

Penalty and interest rules still apply.

Community members and businesses who file taxes with the Province or claim refunds from the Province, including logging tax, employer health tax, insurance premium tax, provincial sales tax and others, may also want to sign up to receive deposits for refunds directly from the Province.

People do not need to wait for their property tax notice to be able to claim a provincial homeowner grant, which reduces property taxes for most homeowners in B.C.

To avoid late penalties and interest though, people should apply for the grant before their property taxes are due.

The B.C. family benefit and other related payments will not be affected and will be delivered this month, along with the Canada child benefit.

To learn more, visit Government of British Columbia.

Chief Coroner Directs Inquest into Tumbler Ridge Deaths

Chief Coroner Directs Inquest into Tumbler Ridge Deaths

Update On New East Courtenay Fire Hall

Update On New East Courtenay Fire Hall

Campbell River's Rail Yard Market Seeks New Entrepreneurs

Campbell River's Rail Yard Market Seeks New Entrepreneurs

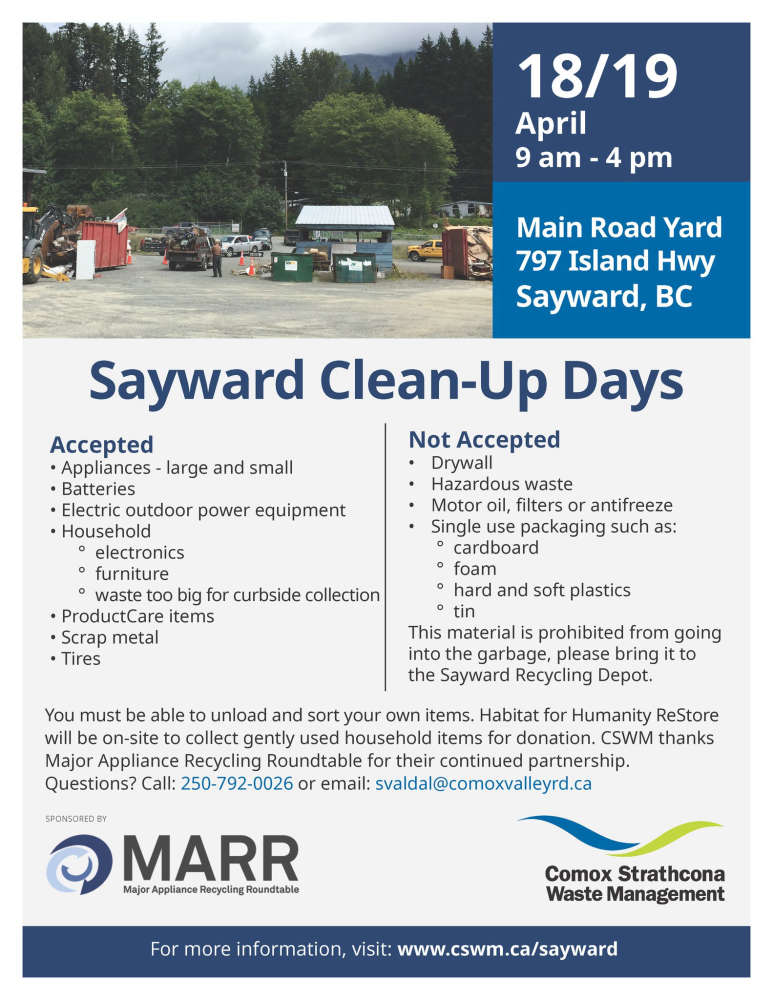

Sayward Clean-Up Days Returns Next Month

Sayward Clean-Up Days Returns Next Month

School District 72 and RCMP response to threats at local schools

School District 72 and RCMP response to threats at local schools