The real estate market in the region has been hot, and Cumberland’s market has been hotter than most.

The real estate market in the region has been hot, and Cumberland’s market has been hotter than most.

During a recent update to council, Maurice Primeau, BC Assessment Authority’s deputy assessor for the region, pointed out the community, with its location and recreation opportunities, had shown higher than average assessment increases during the last year.

While most of north Vancouver Island posted assessment value increases of at least 30 per cent for single-family residential, Cumberland’s average was 38 per cent higher than the previous year’s value, Primeau said. Courtenay and Comox were at 35 per cent, Campbell River was 34 per cent, Port Hardy was 39 per cent and Port Alice was 35 per cent. Port McNeil actually rose by 43 per cent.

Primeau noted with changes in interest rates, recent market activity in the region is slowing a little, with homes staying on the market a bit longer and less ‘overbidding’ on homes once they are up for sale.

Primeau also looked into data on managed forest specifically in response to a request from Cumberland’s council. Of note, he said the latest value shows a drop of $635,000. The total value is based on factors such as soil, trees and topography. The value of the timber is only taken into account one time, whenever it is harvested, then removed as of the next year, which is what happened in this case to explain the drop.

Council had questions about the process and how the village can change the way the rates are calculated for the managed forest land in order to provide more consistency for what the forest companies pay.

In his presentation, Primeau also touched on misconceptions around what people’s assessments mean versus their actual property tax rates, saying the assessments are only one factor, along with the rates, used to calculate property taxes. The rates, and ultimately the tax levies, are then calculated by a taxing authority like a local government.

The role for BC Assessment, Primeau added, is to determine how to weigh the value of each property in a class fairly against similar ones.

Comox Valley RCMP Say Teenager Found Safe, But Seeking 53-Year Old Missing Man

Comox Valley RCMP Say Teenager Found Safe, But Seeking 53-Year Old Missing Man

Communities To Celebrate Victoria Day This Weekend

Communities To Celebrate Victoria Day This Weekend

A Lot To Enjoy At The Comox Air Show This Weekend

A Lot To Enjoy At The Comox Air Show This Weekend

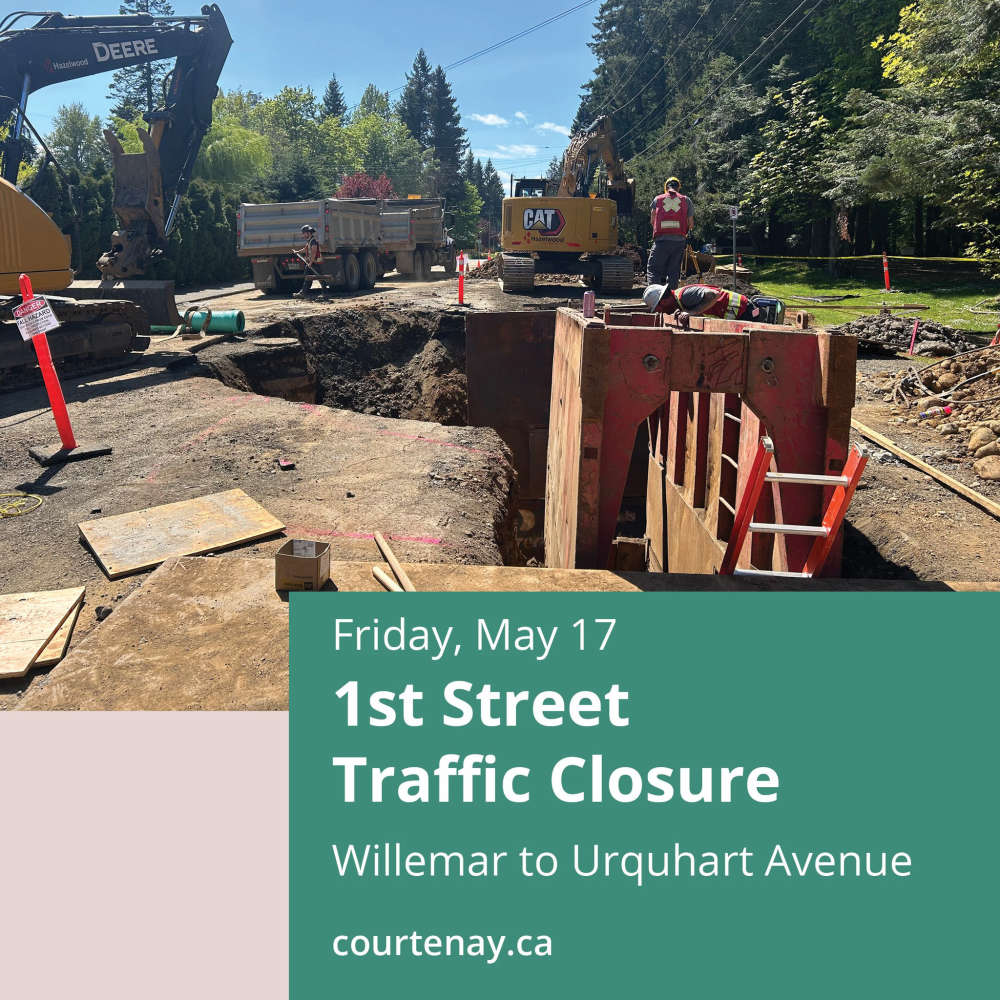

Road Closure On 1st Street In Courtenay Today

Road Closure On 1st Street In Courtenay Today

Historic Haida Aboriginal Title Legislation Receives Royal Assent

Historic Haida Aboriginal Title Legislation Receives Royal Assent