Courtenay Council has reviewed public feedback on the 2026 budget and considered the bylaw that sets the City’s financial plan for the next five years.

Council received a briefing note summarizing results from the City’s online Budget Engagement tool, which ran from January 6 to 27.

The interactive “Balancing Act” simulation allowed residents to adjust revenues and service levels while keeping the budget balanced.

The tool recorded 804 unique views and generated about 73 hours of active engagement, with 54 residents submitting completed budget scenarios.

Results show varied views on spending priorities.

Recreation, Culture and Community Services and Development Services saw some of the largest average decreases among those who chose to cut funding.

Public Safety – Police and Transfers to Reserves were among the highest average increases for participants who opted to boost spending.

Most respondents chose to increase or maintain property taxes rather than reduce service levels.

Written feedback reflected appreciation for Courtenay’s natural setting and community feel, along with concerns about taxes, downtown safety, transportation and communication with Council.

Council also considered the 2026–2030 Financial Plan Bylaw No. 3211, which outlines the City’s five-year operating and capital budget as required under the Community Charter.

The plan reflects previous direction from Council, including a 6.0-percent tax change scenario for 2026 and a surplus balance target equal to 15 percent of the 2025 General Fund budgeted spending.

The bylaw authorizes revenue collection and spending for 2026 and provides financial authority through the October 2026 municipal election, unless amended.

The 2026 Financial Plan includes $83.4 million in revenue and $23.5 million in borrowing, largely to support capital projects such as the $18 million East Side Fire Hall, Ryan Road sidewalk improvements, and storm and road upgrades on Braidwood Road.

For an average residential home valued at $752,000, total City property charges are projected to rise by about 7 percent.

Overall property-related charges, including those from other taxing authorities, are expected to increase by an estimated 6.6-percent.

Find the full agenda, February 11 meeting information, and live stream at City of Courtenay.

Comox Valley Schools Mark Provincial Day Of Mourning For Tumbler Ridge

Comox Valley Schools Mark Provincial Day Of Mourning For Tumbler Ridge

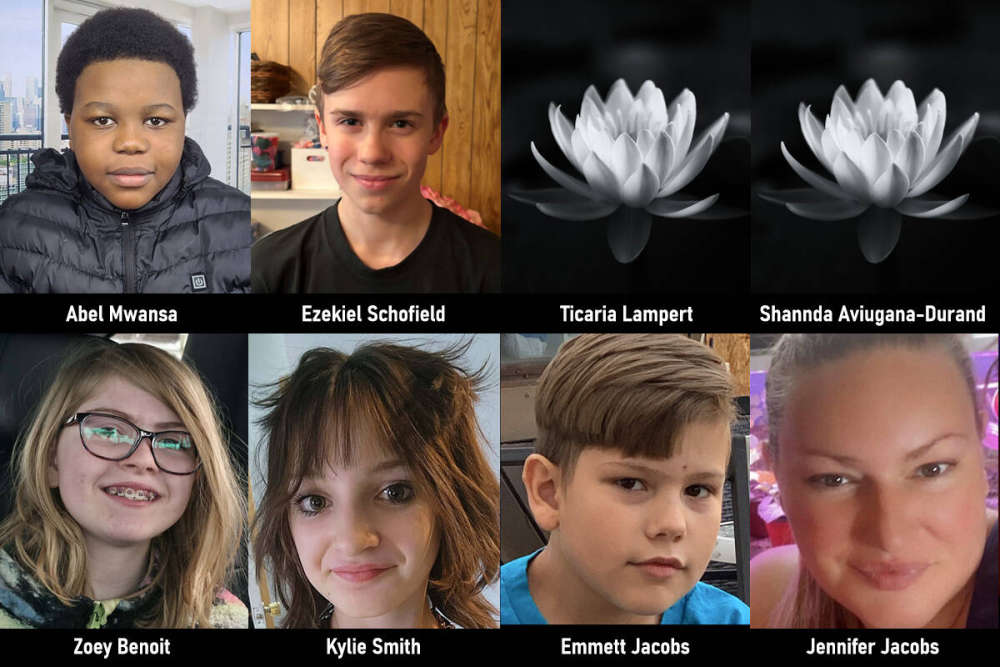

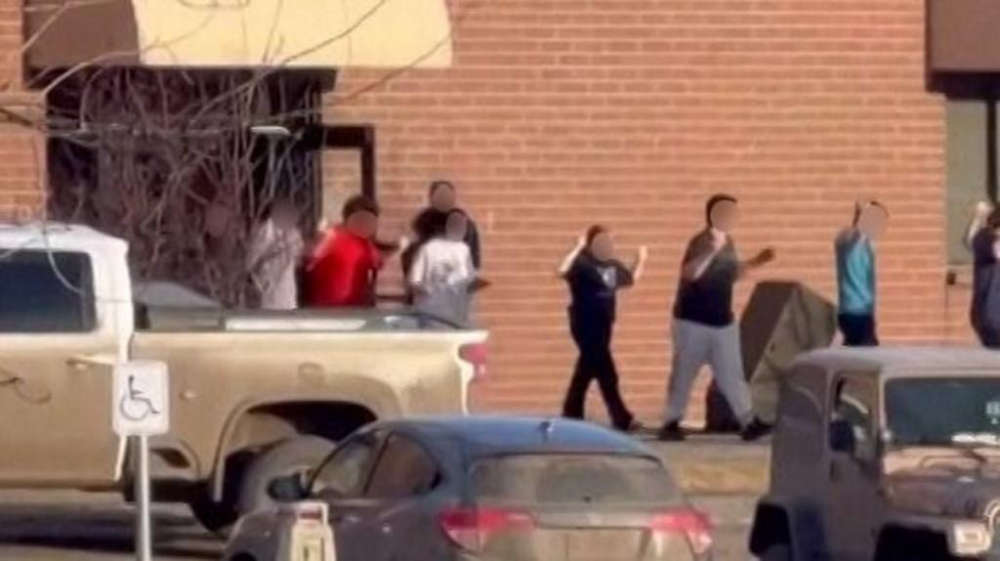

RCMP Confirm Victims Of Tumbler Ridge Shootings

RCMP Confirm Victims Of Tumbler Ridge Shootings

Comox Valley Officials Tour North Cowichan RCMP Detachment As New Building Push Continues

Comox Valley Officials Tour North Cowichan RCMP Detachment As New Building Push Continues

Local Governments Lower Flags, Offer Support Following Tumbler Ridge Tragedy

Local Governments Lower Flags, Offer Support Following Tumbler Ridge Tragedy

Nine Dead In Tumbler Ridge School Shooting, Two Youths In Serious Condition

Nine Dead In Tumbler Ridge School Shooting, Two Youths In Serious Condition